There are no guarantees that working with an adviser will yield positive returns. Youd pay a more advantageous long-term capital gains tax rate if you owned it for more than a year: 0, 15, or 20, depending on your modified adjusted gross income. Long-Term Capital Gains Tax 2022 Tax rate, Single, Head of household 0, Up to 40,400, Up to 54,100 15, 40,401 to 445,850, 54,101 to 473,750 20. The rates below would apply to that income. The actual rates didn't change, but the income brackets did adjust slightly. The taxes you pay in early 2023 are for 2022 income. Remember, this isn't for the tax return you file in 2022, but rather, any gains you incur from Januto Decemand you file that tax return in January 2023.

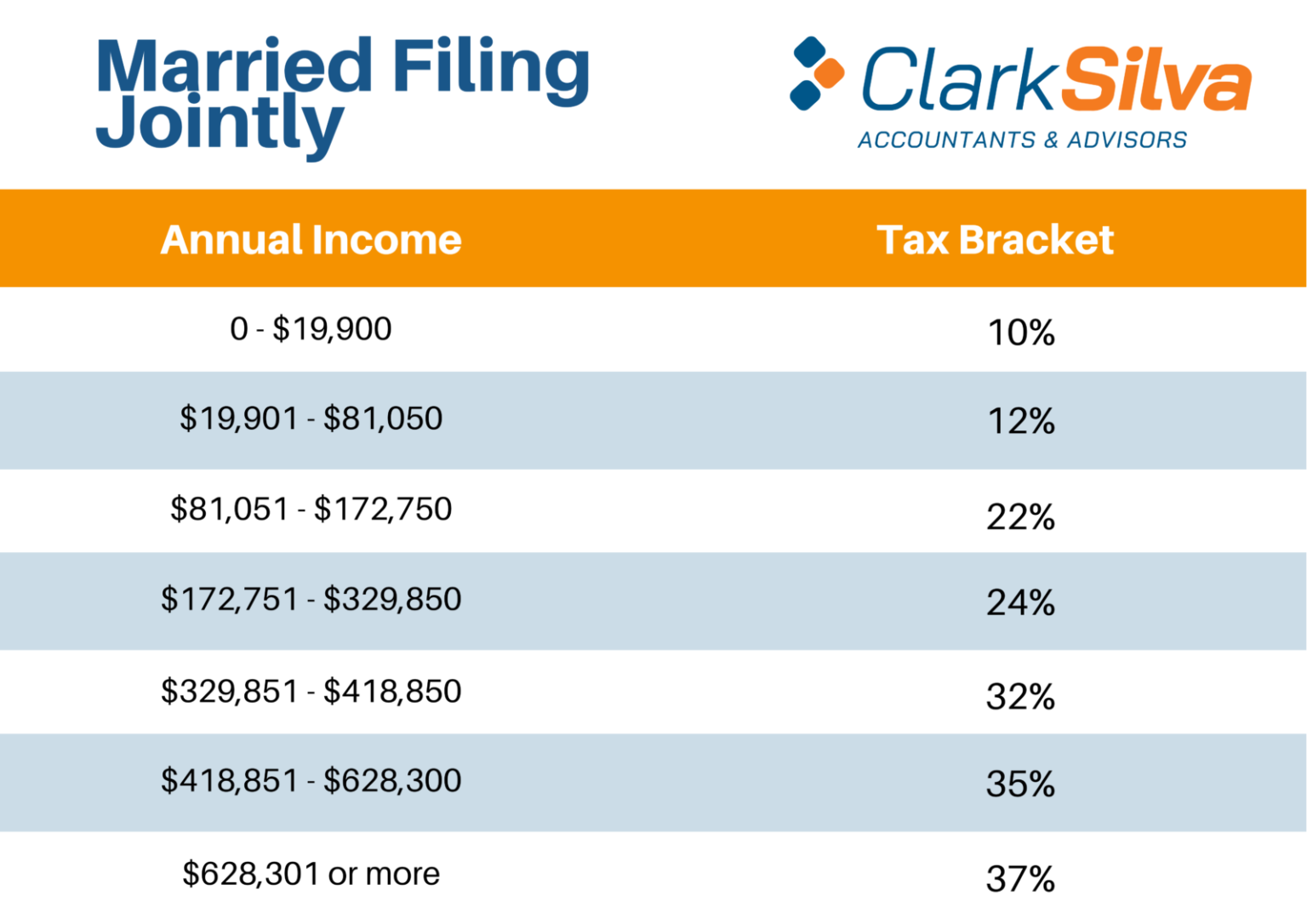

Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). Long-term capital gains are taxed at only three rates: 0, 15, and 20. All investing involves risk, including loss of principal. Short-term capital gains are taxed at ordinary income tax rates up to 37 (the seven marginal tax brackets are 10, 12, 22, 24, 32, 35, and 37). This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Qualified stock dividend and capital gains tax rates for assets held at least a year range from 0 to 20, depending on taxable income and filing status. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. Capital Gain Exclusion for Sale of Qualified Stock (HF 2317) Tax years beginning in 2023 - 33 Tax years beginning in 2024 - 66 Tax years beginning in or. Marginal bands mean you only pay the specified tax rate on that. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. For the 2023/24 tax year, if you live in England, Wales or Northern Ireland, there are three marginal income tax bands the 20 basic rate, the 40 higher rate and the 45 additional rate (also remember your personal allowance starts to shrink once earnings hit £100,000). The 2021 Washington State Legislature recently passed ESSB 5096 (RCW 82.87) which creates a 7 tax on the sale or exchange of long-term capital assets such as. Securities and Exchange Commission as an investment adviser. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. The estimated long-term and short-term capital gain distributions for 2023 are listed below.

0 kommentar(er)

0 kommentar(er)